Grundläggande statistik

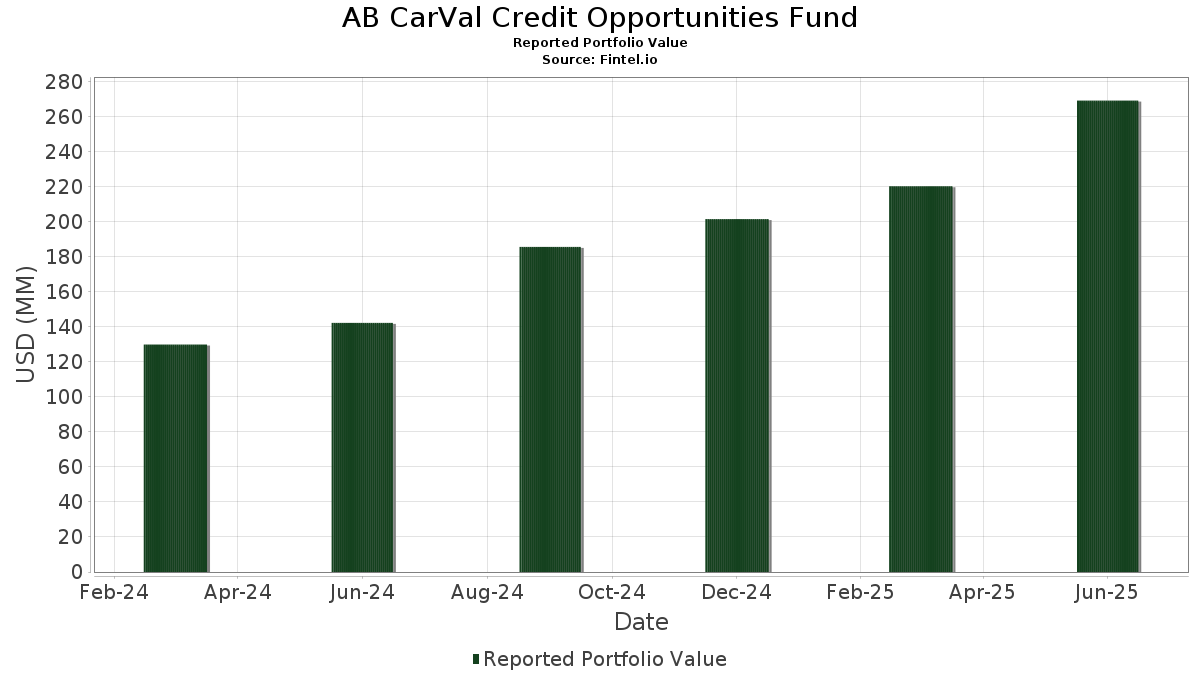

| Portföljvärde | $ 269 350 471 |

| Aktuella positioner | 282 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

AB CarVal Credit Opportunities Fund har redovisat 282 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 269 350 471 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). AB CarVal Credit Opportunities Funds största innehav är Spectacle Gary Holdings LLC 2021 Term Loan B (US:US40443NAC48) , BX TR 2021-ARIA G 1ML+320 10/15/2036 144A (US:US05608RAQ83) , MTN COML MTG TR 2022-LPFL F TSFR1M+393.47 03/15/2039 144A (US:US62475WAL90) , Alphia, Term Loan (US:US57778YAB11) , and Ashford Hospitality Trust 2018-ASHF (US:US04410RAJ59) . AB CarVal Credit Opportunities Funds nya positioner inkluderar Spectacle Gary Holdings LLC 2021 Term Loan B (US:US40443NAC48) , BX TR 2021-ARIA G 1ML+320 10/15/2036 144A (US:US05608RAQ83) , MTN COML MTG TR 2022-LPFL F TSFR1M+393.47 03/15/2039 144A (US:US62475WAL90) , Alphia, Term Loan (US:US57778YAB11) , and Ashford Hospitality Trust 2018-ASHF (US:US04410RAJ59) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 12,51 | 4,2210 | 4,2210 | ||

| 10,03 | 12,48 | 4,2106 | 4,2106 | |

| 9,33 | 11,27 | 3,8054 | 3,8054 | |

| 7,72 | 7,93 | 2,6762 | 2,6762 | |

| 2,63 | 4,08 | 1,3759 | 1,3759 | |

| 3,95 | 1,3319 | 1,3319 | ||

| 3,43 | 3,84 | 1,2953 | 1,2953 | |

| 3,84 | 3,80 | 1,2840 | 1,2840 | |

| 3,64 | 3,67 | 1,2393 | 1,2393 | |

| 3,27 | 3,59 | 1,2123 | 1,2123 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| −1,34 | −0,4518 | −0,4518 | ||

| 4,05 | 1,3685 | −0,2391 | ||

| −0,67 | −0,2265 | −0,2265 | ||

| 0,11 | 0,0373 | −0,2220 | ||

| 2,64 | 0,8897 | −0,2083 | ||

| −0,59 | −0,1993 | −0,1993 | ||

| 3,12 | 1,0522 | −0,1882 | ||

| 2,72 | 0,9165 | −0,1869 | ||

| −0,54 | −0,1809 | −0,1809 | ||

| 2,46 | 0,8286 | −0,1673 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-08-22 för rapporteringsperioden 2025-06-30. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | Genomsnittligt aktiepris | Aktier (MM) |

ΔAktier (%) |

ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| LBZST 2025-A CERT 0% 08-15-2031 / ABS-O (000000000) | 12,51 | 4,2210 | 4,2210 | ||||||

| RENASCENTIA SPV S RL / EC (000000000) | 10,03 | 12,48 | 4,2106 | 4,2106 | |||||

| POWIS FINANCE S.A R.L. / EC (000000000) | 9,33 | 11,27 | 3,8054 | 3,8054 | |||||

| CVI OCT Acquisition Trust / EC (000000000) | 7,72 | 7,93 | 2,6762 | 2,6762 | |||||

| Kielder Funding Ltd / EC (000000000) | 2,63 | 4,08 | 1,3759 | 1,3759 | |||||

| Route 66 Development Authority Term Loan / LON (US77929HAB42) | 4,05 | 0,25 | 1,3685 | −0,2391 | |||||

| Goldenpeaks Capital / ABS-MBS (000000000) | 3,95 | 1,3319 | 1,3319 | ||||||

| AERGO CAPITAL - 59 - WESTJET B737-800 x8 / EC (000000000) | 3,43 | 3,84 | 1,2953 | 1,2953 | |||||

| CVI SYM HOLDINGS LLC / EC (000000000) | 3,84 | 3,80 | 1,2840 | 1,2840 | |||||

| CVI Thompson Holdings, LLC / EC (000000000) | 3,64 | 3,67 | 1,2393 | 1,2393 | |||||

| CVI OCT Investment Trust / EC (000000000) | 3,27 | 3,59 | 1,2123 | 1,2123 | |||||

| CREDITABLE OPPORTUNITIES FD II / EC (000000000) | 2,79 | 3,48 | 1,1757 | 1,1757 | |||||

| RECKNITZ SARL / EC (000000000) | 2,92 | 3,44 | 1,1619 | 1,1619 | |||||

| POWIS FINANCE S A R L / EC (000000000) | 0,76 | 3,19 | 1,0759 | 1,0759 | |||||

| Verus Securitization Trust 2023-INV2 / ABS-MBS (US92540BAF67) | 3,12 | −0,10 | 1,0522 | −0,1882 | |||||

| US40443NAC48 / Spectacle Gary Holdings LLC 2021 Term Loan B | 2,72 | −2,16 | 0,9165 | −0,1869 | |||||

| EFMT 2024-INV2 / ABS-MBS (US26844LAF58) | 2,70 | 0,11 | 0,9110 | −0,1610 | |||||

| Atrium Hotel Portfolio Trust 2024-ATRM / ABS-MBS (US04963XAL82) | 2,64 | −4,60 | 0,8897 | −0,2083 | |||||

| CVI LB INVESTMENT TRUST II / EC (000000000) | 2,54 | 2,63 | 0,8871 | 0,8871 | |||||

| US36192CAL90 / GSMS 13-GC10 B 144A 3.682% 02-10-46 | 2,61 | 1,24 | 0,8799 | −0,1433 | |||||

| ILPT Commercial Mortgage Trust 2025-LPF2 / ABS-MBS (US451955AJ74) | 2,55 | 0,8620 | 0,8620 | ||||||

| IP 2025-IP Mortgage Trust / ABS-MBS (US449843AL54) | 2,54 | 0,8575 | 0,8575 | ||||||

| BAMLL Trust 2025-ASHF / ABS-MBS (US05494CAG06) | 2,51 | 0,40 | 0,8464 | −0,1465 | |||||

| SDAL Trust 2025-DAL / ABS-MBS (US78437RAG48) | 2,50 | 0,8450 | 0,8450 | ||||||

| Twitter Inc Term Loan / LON (US90184NAG34) | 2,46 | −2,00 | 0,8286 | −0,1673 | |||||

| VMED O2 UK Holdco 4 Limited 2023 EUR Term Loan Z / LON (XAG9368PBJ21) | 2,39 | 9,29 | 0,8062 | −0,0624 | |||||

| First Brands Revolving Loan Facility / DBT (000000000) | 2,39 | 0,8061 | 0,8061 | ||||||

| Coral Reef SPV S.r.l. / EC (000000000) | 1,89 | 2,38 | 0,8032 | 0,8032 | |||||

| CVI SBT ACQUISITION TRUST / EC (000000000) | 2,27 | 2,31 | 0,7795 | 0,7795 | |||||

| HIH Trust 2024-61P / ABS-MBS (US40444VAL53) | 2,27 | −1,09 | 0,7658 | −0,1463 | |||||

| Verus Securitization Trust 2024-7 / ABS-MBS (US924925AH38) | 2,21 | 0,00 | 0,7458 | −0,1323 | |||||

| Nassau Euro CLO I DAC / ABS-CBDO (XS2400033929) | 2,15 | 9,69 | 0,7263 | −0,0535 | |||||

| FCT EUROTRUCK LEASE / ABS-O (FR001400PAS9) | 2,09 | 8,17 | 0,7067 | −0,0627 | |||||

| US05608RAQ83 / BX TR 2021-ARIA G 1ML+320 10/15/2036 144A | 2,09 | 2,00 | 0,7051 | −0,1094 | |||||

| US62475WAL90 / MTN COML MTG TR 2022-LPFL F TSFR1M+393.47 03/15/2039 144A | 2,01 | 0,15 | 0,6788 | −0,1194 | |||||

| BX Commercial Mortgage Trust 2024-SLCT / ABS-MBS (US12433JAQ31) | 2,00 | 0,91 | 0,6758 | −0,1131 | |||||

| COMM 2024-CBM Mortgage Trust / ABS-MBS (US12674GAN43) | 2,00 | 2,36 | 0,6737 | −0,1016 | |||||

| Heartland Dental LLC 2024 Term Loan / LON (US42236WAW73) | 1,99 | 0,25 | 0,6717 | −0,1174 | |||||

| Foundation Finance Trust 2025-1 / ABS-O (US35040WAE75) | 1,99 | 0,66 | 0,6713 | −0,1140 | |||||

| Verus Securitization Trust 2024-4 / ABS-MBS (US92540GAF54) | 1,98 | −0,05 | 0,6682 | −0,1189 | |||||

| New Residential Mortgage Loan Trust 2023-NQM1 / ABS-MBS (US64831HAF01) | 1,97 | 0,00 | 0,6658 | −0,1181 | |||||

| US57778YAB11 / Alphia, Term Loan | 1,97 | 0,82 | 0,6650 | −0,1118 | |||||

| US04410RAJ59 / Ashford Hospitality Trust 2018-ASHF | 1,96 | 0,00 | 0,6621 | −0,1176 | |||||

| SWCH Commercial Mortgage Trust 2025-DATA / ABS-MBS (US78489CAF68) | 1,94 | −1,82 | 0,6563 | −0,1310 | |||||

| Verus Securitization Trust 2024-9 / ABS-MBS (US92540RAH75) | 1,94 | 0,10 | 0,6560 | −0,1156 | |||||

| US78457JAQ58 / SMRT 2022-MINI SOFR30A+330 01/15/2024 144A | 1,94 | 3,19 | 0,6549 | −0,0926 | |||||

| GoodLeap Home Improvement Solutions Trust 2025-1 / ABS-O (US38237EAC84) | 1,90 | −6,45 | 0,6415 | −0,1660 | |||||

| Veros Auto Receivables Trust 2025-1 / ABS-O (US92511BAD64) | 1,87 | 0,6304 | 0,6304 | ||||||

| Verus Securitization Trust 2023-6 / ABS-MBS (US92539XAF15) | 1,87 | 0,00 | 0,6301 | −0,1120 | |||||

| POWIS FINANCE S.A R.L. / EC (000000000) | 1,45 | 1,85 | 0,6243 | 0,6243 | |||||

| US64828GCT58 / New Residential Mortgage Loan Trust 2019-6 | 1,83 | −0,27 | 0,6185 | −0,1121 | |||||

| US64830MFJ71 / New Residential Mortgage Loan Trust, Series 2019-5A, Class B7 | 1,80 | −3,96 | 0,6064 | −0,1370 | |||||

| PPC Zeus DAC / ABS-O (XS2269203316) | 1,79 | 8,97 | 0,6028 | −0,0487 | |||||

| US05610BAQ95 / BXSC 2022-WSS F 5.579% 03/15/2035 144A | 1,75 | −0,34 | 0,5920 | −0,1077 | |||||

| US78457JAN28 / SMRT, Series 2022-MINI, Class E | 1,75 | 1,57 | 0,5906 | −0,0940 | |||||

| UNITED TALENT AGENCY LLC 2025 TERM LOAN B / LON (US91301QAN79) | 1,73 | 0,5855 | 0,5855 | ||||||

| US64830DCF87 / New Residential Mortgage Loan Trust, Series 2019-2A, Class B6 | 1,70 | −0,23 | 0,5744 | −0,1035 | |||||

| Velocity Commercial Capital Loan Trust 2023-3 / ABS-MBS (US92258WAU99) | 1,64 | 0,5537 | 0,5537 | ||||||

| CFMT 2024-R1 LLC / ABS-MBS (US12530YAE95) | 1,62 | 0,93 | 0,5468 | −0,0913 | |||||

| NEXUS Buyer LLC 2025 Term Loan B / LON (US65343UAH59) | 1,61 | 0,94 | 0,5438 | −0,0908 | |||||

| GoodLeap Home Improvement Solutions Trust 2025-2 / ABS-O (US38238FAC41) | 1,61 | 0,5421 | 0,5421 | ||||||

| US46654PAN69 / JPMCC_21-HTL5 | 1,58 | −1,07 | 0,5332 | −0,1012 | |||||

| AERGO CAPITAL - 21 - BAMBOO / EC (000000000) | 1,80 | 1,53 | 0,5178 | 0,5178 | |||||

| New Residential Mortgage Loan Trust 2018-2 / ABS-MBS (US64828CEN56) | 1,51 | −0,46 | 0,5105 | −0,0936 | |||||

| US449652AJ58 / ILPT COML MTG TR 2022-LPF2 TSFR1M+594 10/15/2039 144A | 1,50 | 0,27 | 0,5051 | −0,0883 | |||||

| Radar Bidco Sarl 2024 USD Term Loan / LON (XAL7781HAD16) | 1,47 | 0,34 | 0,4959 | −0,0863 | |||||

| Mariner Finance Issuance Trust 2025-A / ABS-O (US567920AE33) | 1,45 | 0,4909 | 0,4909 | ||||||

| AERGO CAPITAL - 65 - JETTIME B737-800 x1 MSN 39057 / EC (000000000) | 1,36 | 1,40 | 0,4729 | 0,4729 | |||||

| LSCS Holdings Inc 2025 Term Loan / LON (000000000) | 1,40 | 0,4725 | 0,4725 | ||||||

| THPT 2023-THL Mortgage Trust / ABS-MBS (US87252LAJ44) | 1,40 | −0,71 | 0,4724 | −0,0878 | |||||

| VERUS 2024 6 B2 VAR 07/25/2069 / ABS-MBS (000000000) | 1,38 | 0,4669 | 0,4669 | ||||||

| New Residential Mortgage Loan Trust 2019-RPL2 / ABS-MBS (US64830HAJ32) | 1,38 | −3,10 | 0,4648 | −0,1002 | |||||

| PGA Trust 2024-RSR2 / ABS-MBS (US69381CAQ06) | 1,38 | 0,36 | 0,4646 | −0,0806 | |||||

| SECURITISATION OF CATALOGUE / ABS-O (XS2678224416) | 1,36 | 6,65 | 0,4602 | −0,0482 | |||||

| First Brands Group LLC 2024 Revolver / LON (000000000) | 1,26 | 0,4238 | 0,4238 | ||||||

| US46654PAQ90 / J.P. Morgan Chase Commercial Mortgage Securities Trust 2021-HTL5 | 1,25 | −3,41 | 0,4215 | −0,0921 | |||||

| CVI MF Acquisition Trust II / EC (000000000) | 1,16 | 1,23 | 0,4151 | 0,4151 | |||||

| Velocity Commercial Capital Loan Trust 2023-2 / ABS-MBS (US92260AAG40) | 1,21 | 0,4072 | 0,4072 | ||||||

| Schoen Klinik SE 2025 EUR Term Loan B / LON (000000000) | 1,17 | 0,3946 | 0,3946 | ||||||

| Newday Funding Master Issuer PLC - Series 2022-2 / ABS-O (XS2498644124) | 1,10 | 5,36 | 0,3717 | −0,0438 | |||||

| POWIS FINANCE S A R L / EC (000000000) | 0,92 | 1,09 | 0,3674 | 0,3674 | |||||

| Morgan Stanley Residential Mortgage Loan Trust 2024-NQM5 / ABS-MBS (US61777QAJ40) | 1,08 | 0,18 | 0,3659 | −0,0645 | |||||

| AERGO CAPITAL - 64 - TRANSAVIA B737-800 x1 MSN 39397 / EC (000000000) | 1,03 | 1,05 | 0,3559 | 0,3559 | |||||

| Jeronimo Funding DAC / ABS-MBS (XS2956119361) | 1,05 | 9,50 | 0,3541 | −0,0268 | |||||

| Banijay Entertainment SAS 2025 USD Term Loan B3 / LON (XAF6456UAE38) | 1,02 | 0,10 | 0,3440 | −0,0610 | |||||

| PGA Trust 2024-RSR2 / ABS-MBS (US69381CAN74) | 1,01 | 100,00 | 0,3403 | 0,1396 | |||||

| AERGO CAPITAL - 33 - IBERIA / EC (000000000) | 0,89 | 0,99 | 0,3327 | 0,3327 | |||||

| SWCH Commercial Mortgage Trust 2025-DATA / ABS-MBS (US78489CAE93) | 0,98 | −1,01 | 0,3308 | −0,0629 | |||||

| BOCA Commercial Mortgage Trust 2024-BOCA / ABS-MBS (US096817AJ00) | 0,93 | 0,43 | 0,3143 | −0,0545 | |||||

| AERGO CAPITAL - 60 - WIZZ AIR A321-200 MSN 6976 / EC (000000000) | 0,83 | 0,92 | 0,3112 | 0,3112 | |||||

| US69380RAD70 / PRPM_23-RCF2 | 0,89 | 1,02 | 0,3003 | −0,0499 | |||||

| Nielsen Consumer Inc 2025 USD Term Loan / LON (US45674PAR55) | 0,85 | 0,12 | 0,2884 | −0,0507 | |||||

| US140944AA76 / Capstone Borrower Inc | 0,83 | 0,2815 | 0,2815 | ||||||

| Velocity Commercial Capital Loan Trust 2024-1 / ABS-MBS (US92261CAR51) | 0,83 | 0,2810 | 0,2810 | ||||||

| US92332YAA91 / Venture Global LNG, Inc. | 0,83 | 0,2791 | 0,2791 | ||||||

| AERGO CAPITAL - 42 - EMIRATES / EC (000000000) | 0,59 | 0,83 | 0,2790 | 0,2790 | |||||

| US69354NAE67 / PRA Group Inc | 0,82 | 0,2771 | 0,2771 | ||||||

| US18972EAB11 / Clydesdale Acquisition Holdings, Inc. | 0,82 | 0,2765 | 0,2765 | ||||||

| Stream Innovations 2025-1 Issuer Trust / ABS-O (US86324XAD75) | 0,81 | 0,2751 | 0,2751 | ||||||

| US88632QAE35 / Picard Midco, Inc. | 0,81 | 0,2726 | 0,2726 | ||||||

| US69145LAC81 / OXFORD FIN LLC/CO ISS II SR UNSECURED 144A 02/27 6.375 | 0,80 | 0,2717 | 0,2717 | ||||||

| US03959KAC45 / Archrock Partners LP / Archrock Partners Finance Corp | 0,80 | 0,2715 | 0,2715 | ||||||

| US11040GAA13 / Bristow Group Inc | 0,80 | 0,2713 | 0,2713 | ||||||

| US031652BK50 / Amkor Technology Inc 6.625% 09/15/2027 144A | 0,80 | 0,2707 | 0,2707 | ||||||

| US603051AC70 / Mineral Resources Ltd | 0,80 | 0,2707 | 0,2707 | ||||||

| US156504AL63 / CENTURY COMMUNITIES REGD 6.75000000 | 0,80 | 0,2706 | 0,2706 | ||||||

| US14575EAA38 / Cars.com Inc | 0,80 | 0,2703 | 0,2703 | ||||||

| US00253XAB73 / American Airlines Inc/AAdvantage Loyalty IP Ltd | 0,80 | 0,2703 | 0,2703 | ||||||

| US78454LAP58 / SM Energy Co | 0,80 | 0,2702 | 0,2702 | ||||||

| US44963BAD01 / IHO Verwaltungs GmbH | 0,80 | 0,2699 | 0,2699 | ||||||

| US914906AU68 / Univision Communications Inc | 0,80 | 0,2693 | 0,2693 | ||||||

| US707569AS84 / Penn National Gaming Inc | 0,80 | 0,2690 | 0,2690 | ||||||

| US37960XAA54 / Global Infrastructure Solutions Inc | 0,80 | 0,2686 | 0,2686 | ||||||

| US67740QAH92 / Ohio National Financial Services, Inc. | 0,80 | 0,2684 | 0,2684 | ||||||

| US775109BS95 / Rogers Communications, Inc. | 0,79 | 0,2680 | 0,2680 | ||||||

| US12116LAA70 / Burford Capital Global Finance LLC | 0,79 | 0,2676 | 0,2676 | ||||||

| US835898AH05 / SOTHEBYS 7.375% 10/15/2027 144A | 0,79 | 0,2671 | 0,2671 | ||||||

| US12543DBG43 / CHS/Community Health Systems Inc | 0,79 | 0,2658 | 0,2658 | ||||||

| SOCA 1 BRR / ABS-O (XS2678222550) | 0,78 | 6,68 | 0,2643 | −0,0278 | |||||

| US913229AA80 / United Wholesale Mortgage LLC | 0,78 | 0,2619 | 0,2619 | ||||||

| SC Germany SA Compartment Consumer 2022-1 / ABS-O (XS2482886475) | 0,78 | 10,40 | 0,2618 | −0,0173 | |||||

| US46205YAA91 / ION Trading Technologies Sarl | 0,77 | 0,2614 | 0,2614 | ||||||

| US38528UAE64 / Grand Canyon University | 0,77 | 0,2606 | 0,2606 | ||||||

| US80874DAA46 / Scientific Games Holdings LP/Scientific Games US FinCo Inc | 0,77 | 19,38 | 0,2601 | −0,0387 | |||||

| Verus Securitization Trust 2024-8 / ABS-MBS (US92540PAF53) | 0,77 | 0,13 | 0,2597 | −0,0460 | |||||

| US68622TAA97 / Organon Finance 1 LLC | 0,77 | 0,2591 | 0,2591 | ||||||

| US039524AA11 / ARCHES BUYER INC 4.25% 06/01/2028 144A | 0,77 | 0,2585 | 0,2585 | ||||||

| US49272YAB92 / Kevlar SpA | 0,77 | 0,2585 | 0,2585 | ||||||

| US31556TAA79 / Fertitta Entertainment LLC / Fertitta Entertainment Finance Co Inc | 0,76 | 0,2576 | 0,2576 | ||||||

| US81254UAK25 / Seaspan Corp | 0,76 | 0,2563 | 0,2563 | ||||||

| US18064PAD15 / Clarivate Science Holdings Corp | 0,75 | 0,2544 | 0,2544 | ||||||

| SECURITISATION OF CATALOGUE / ABS-O (XS2678226890) | 0,75 | 6,66 | 0,2543 | −0,0265 | |||||

| AERGO CAPITAL - 16 - ALBASTAR MSN 27992 / EC (000000000) | 0,75 | 0,75 | 0,2522 | 0,2522 | |||||

| AERGO CAPITAL - 63 - WIZZ AIR A320-200 MSN 5660 / EC (000000000) | 0,69 | 0,74 | 0,2483 | 0,2483 | |||||

| Stonegate Pub Co Financing 2019 PLC / DBT (XS2870855082) | 0,73 | 6,77 | 0,2447 | −0,0254 | |||||

| Stonegate Pub Co Financing 2019 PLC / DBT (XS2870873655) | 0,72 | 7,92 | 0,2439 | −0,0222 | |||||

| AERGO CAPITAL - 61 - WIZZ AIR A320-200 MSN 6662 / EC (000000000) | 0,62 | 0,70 | 0,2355 | 0,2355 | |||||

| SHR Trust 2024-LXRY / ABS-MBS (US784234AJ55) | 0,69 | −0,72 | 0,2344 | −0,0439 | |||||

| SC Germany SA Compartment Consumer 2022-1 / ABS-O (XS2482886558) | 0,69 | 10,43 | 0,2323 | −0,0158 | |||||

| CVI CB Holdings V, LLC / EC (000000000) | 0,86 | 0,67 | 0,2259 | 0,2259 | |||||

| AERGO CAPITAL - 31 - Q400 x20 / EC (000000000) | 1,19 | 0,67 | 0,2247 | 0,2247 | |||||

| CVI CB Holdings IV, LLC / EC (000000000) | 0,70 | 0,65 | 0,2180 | 0,2180 | |||||

| AERGO CAPITAL - 28 - ATR 72-600 x4 / EC (000000000) | 0,70 | 0,61 | 0,2045 | 0,2045 | |||||

| Clavel Residential 3 DAC / ABS-MBS (XS2648668122) | 0,61 | 9,80 | 0,2042 | −0,0150 | |||||

| Pembroke Property Finance 3 DAC / ABS-MBS (XS2972989847) | 0,58 | 7,96 | 0,1968 | −0,0181 | |||||

| CVI CB Holdings V, LLC / EC (000000000) | 0,01 | 0,58 | 0,1959 | 0,1959 | |||||

| Shamrock Residential / ABS-MBS (XS2584644194) | 0,57 | 8,51 | 0,1939 | −0,0166 | |||||

| US45344LAC72 / Crescent Energy Finance LLC | 0,57 | 0,1933 | 0,1933 | ||||||

| AERGO CAPITAL - 39 - MSN 4457 and 40259 / EC (000000000) | 0,56 | 0,56 | 0,1885 | 0,1885 | |||||

| US92556HAE71 / Paramount Global | 0,54 | 0,1821 | 0,1821 | ||||||

| Jeronimo Funding DAC / ABS-MBS (XS2956119528) | 0,51 | 9,66 | 0,1728 | −0,0127 | |||||

| US05606DAL29 / BX Trust 2022-PSB | 0,51 | −1,16 | 0,1724 | −0,0328 | |||||

| AERGO CAPITAL - 62 - IBERIA A320-200 MSN 5692 / EC (000000000) | 0,45 | 0,50 | 0,1681 | 0,1681 | |||||

| AERGO CAPITAL - 29 - SAS MSN 3335 / EC (000000000) | 0,46 | 0,49 | 0,1653 | 0,1653 | |||||

| New Residential Mortgage Loan Trust 2018-1 / ABS-MBS (US64830GCC87) | 0,49 | −0,61 | 0,1648 | −0,0308 | |||||

| Verus Securitization Trust 2025-5 / ABS-MBS (US92540XAF87) | 0,49 | 0,1644 | 0,1644 | ||||||

| Verus Securitization Trust 2025-1 / ABS-MBS (US92540TAF75) | 0,49 | 0,21 | 0,1638 | −0,0289 | |||||

| PRPM 2025-RCF3 LLC / ABS-MBS (US69392PAF27) | 0,45 | 0,1532 | 0,1532 | ||||||

| Jeronimo Funding DAC / ABS-MBS (XS2956119106) | 0,45 | 9,44 | 0,1527 | −0,0117 | |||||

| Bbva Consumer Auto 2024-1 FT / ABS-O (ES0305796031) | 0,45 | 0,89 | 0,1523 | −0,0255 | |||||

| EUROTRUCK LSE 49ABS / ABS-O (FR001400PAQ3) | 0,45 | 8,78 | 0,1507 | −0,0126 | |||||

| Dividend Solar Loans 2019-1 LLC / ABS-O (US255388AC40) | 0,41 | −4,48 | 0,1370 | −0,0319 | |||||

| Mill City Solar Loan 2019-2 Ltd / ABS-O (US59982VAD10) | 0,37 | −2,37 | 0,1249 | −0,0259 | |||||

| INTERSECT POWER COMMON UNITS / EC (000000000) | 0,05 | 0,36 | 0,1211 | 0,1211 | |||||

| Mill City Solar Loan 2020-1 Ltd / ABS-O (US59982XAD75) | 0,35 | 0,29 | 0,1185 | −0,0206 | |||||

| Extended Stay America Trust 2021-ESH / ABS-MBS (US30227FAQ37) | 0,34 | −3,17 | 0,1134 | −0,0246 | |||||

| Mill City Mortgage Loan Trust 2018-4 / ABS-MBS (US59980YAL92) | 0,32 | −2,45 | 0,1076 | −0,0224 | |||||

| Shamrock Residential / ABS-MBS (XS2584644277) | 0,31 | 7,67 | 0,1044 | −0,0100 | |||||

| SC Germany SA Compartment Consumer 2024-1 / ABS-O (XS2798860628) | 0,28 | −11,11 | 0,0945 | −0,0308 | |||||

| Mill City Solar Loan 2019-2 Ltd / ABS-O (US59982VAC37) | 0,27 | −4,58 | 0,0916 | −0,0216 | |||||

| Mill City Mortgage Loan Trust 2023-NQM1 / ABS-MBS (US59980DAE13) | 0,23 | 1,30 | 0,0791 | −0,0129 | |||||

| Mill City Mortgage Loan Trust 2019-GS2 / ABS-MBS (US59981TAS42) | 0,23 | 0,43 | 0,0787 | −0,0137 | |||||

| AERGO CAPITAL - 20 - AFRIJET MSN 1285 / EC (000000000) | 0,20 | 0,23 | 0,0770 | 0,0770 | |||||

| Shamrock Residential / ABS-MBS (XS2584644608) | 0,22 | 4,33 | 0,0734 | −0,0093 | |||||

| Mill City Mortgage Loan Trust 2019-GS2 / ABS-MBS (US59981TAP03) | 0,22 | 1,90 | 0,0727 | −0,0113 | |||||

| US12651QAQ29 / CSMC Trust 2017-CHOP | 0,21 | −1,83 | 0,0724 | −0,0144 | |||||

| Mill City Mortgage Loan Trust 2023-NQM1 / ABS-MBS (US59980DAF87) | 0,21 | 0,49 | 0,0693 | −0,0119 | |||||

| New Residential Mortgage Loan Trust 2016-2 / ABS-MBS (US64829GAR02) | 0,20 | −1,02 | 0,0661 | −0,0123 | |||||

| XS1750118462 / Country Garden Holdings Co Ltd | 0,19 | −20,25 | 0,0640 | −0,0304 | |||||

| KINBN 2025-RPL1 RFN 0% 06-24-2078 / ABS-MBS (000000000) | 0,17 | 0,0578 | 0,0578 | ||||||

| New Residential Mortgage Loan Trust 2016-1 / ABS-MBS (US64829FAP62) | 0,13 | −0,74 | 0,0455 | −0,0085 | |||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,13 | 0,0449 | 0,0449 | ||||||

| Shamrock Residential / ABS-MBS (XS2584644517) | 0,13 | 5,60 | 0,0447 | −0,0052 | |||||

| Mill City Mortgage Loan Trust 2019-1 / ABS-MBS (US59981AAM80) | 0,13 | −6,02 | 0,0425 | −0,0104 | |||||

| Mill City Mortgage Loan Trust 2023-NQM1 / ABS-MBS (US59980DAD30) | 0,12 | 0,00 | 0,0421 | −0,0075 | |||||

| INTERSECT POWER PREFERRED UNITS / EC (000000000) | 0,02 | 0,12 | 0,0419 | 0,0419 | |||||

| Mill City Mortgage Loan Trust 2019-GS2 / ABS-MBS (US59981TAV70) | 0,12 | −0,81 | 0,0414 | −0,0078 | |||||

| Mill City Mortgage Loan Trust 2019-1 / ABS-MBS (US59981AAN63) | 0,12 | −3,20 | 0,0410 | −0,0088 | |||||

| Mill City Mortgage Loan Trust 2018-4 / ABS-MBS (US59980YAM75) | 0,11 | −2,65 | 0,0374 | −0,0077 | |||||

| US89989FAA21 / Turbine Engines Securitization Ltd. | 0,11 | −83,13 | 0,0373 | −0,2220 | |||||

| INTERSECT POWER, LLC - CLASS B / EC (000000000) | 0,02 | 0,11 | 0,0364 | 0,0364 | |||||

| Mill City Mortgage Loan Trust 2019-1 / ABS-MBS (US59981AAP12) | 0,10 | −4,63 | 0,0350 | −0,0082 | |||||

| Mill City Mortgage Loan Trust 2019-GS2 / ABS-MBS (US59981TAY10) | 0,10 | −1,90 | 0,0350 | −0,0070 | |||||

| Mill City Mortgage Loan Trust 2018-4 / ABS-MBS (US59980YAN58) | 0,10 | −2,86 | 0,0347 | −0,0072 | |||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,10 | 0,0330 | 0,0330 | ||||||

| US59982WAC10 / Mill City Solar Loan 2019-1 Ltd | 0,09 | −3,09 | 0,0320 | −0,0068 | |||||

| GALINDO HOLDINGS S.A R.L. / EC (000000000) | 0,28 | 0,09 | 0,0309 | 0,0309 | |||||

| AERGO CAPITAL - 41 - EASYJET / EC (000000000) | 0,09 | 0,08 | 0,0286 | 0,0286 | |||||

| Mill City Mortgage Loan Trust 2019-1 / ABS-MBS (US59981AAQ94) | 0,08 | −4,65 | 0,0277 | −0,0068 | |||||

| Mill City Mortgage Loan Trust 2019-GS2 / ABS-MBS (US59981TBB08) | 0,08 | −2,60 | 0,0255 | −0,0054 | |||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,07 | 0,0251 | 0,0251 | ||||||

| US59982WAD92 / Mill City Solar Loan 2019-1 Ltd | 0,07 | −1,35 | 0,0249 | −0,0048 | |||||

| AERGO CAPITAL - 11 - QATAR / EC (000000000) | 0,05 | 0,07 | 0,0230 | 0,0230 | |||||

| Mill City Mortgage Loan Trust 2018-4 / ABS-MBS (US59980YAP07) | 0,07 | −2,90 | 0,0227 | −0,0051 | |||||

| Mill City Mortgage Loan Trust 2019-GS2 / ABS-MBS (US59981TBE47) | 0,06 | −4,62 | 0,0211 | −0,0049 | |||||

| XS2240971742 / Country Garden Holdings Co Ltd | 0,06 | −22,37 | 0,0200 | −0,0105 | |||||

| Mill City Mortgage Loan Trust 2019-GS2 / ABS-MBS (US59981TBG94) | 0,06 | −9,84 | 0,0189 | −0,0057 | |||||

| Mill City Mortgage Loan Trust 2018-4 / ABS-MBS (US59980YAQ89) | 0,05 | −7,14 | 0,0177 | −0,0048 | |||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,04 | 0,0150 | 0,0150 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,04 | 0,0139 | 0,0139 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,04 | 0,0121 | 0,0121 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,03 | 0,0098 | 0,0098 | ||||||

| US89989FAB04 / Turbine Engines Securitization Ltd. | 0,03 | −78,81 | 0,0087 | −0,0383 | |||||

| CVI CB Holdings IV, LLC / EC (000000000) | 0,00 | 0,02 | 0,0062 | 0,0062 | |||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,02 | 0,0059 | 0,0059 | ||||||

| Mill City Mortgage Loan Trust 2018-4 / ABS-MBS (US59980YAR62) | 0,02 | 0,00 | 0,0056 | −0,0011 | |||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,02 | 0,0055 | 0,0055 | ||||||

| Mill City Mortgage Loan Trust 2019-1 / ABS-MBS (US59981AAS50) | 0,02 | −6,25 | 0,0054 | −0,0011 | |||||

| Mill City Mortgage Loan Trust 2019-GS2 / ABS-MBS (US59981TBF12) | 0,01 | −6,67 | 0,0049 | −0,0011 | |||||

| AERGO CAPITAL - 35 - B737 x3 / EC (000000000) | 0,00 | 0,01 | 0,0048 | 0,0048 | |||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,01 | 0,0039 | 0,0039 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,01 | 0,0033 | 0,0033 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,01 | 0,0027 | 0,0027 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,01 | 0,0025 | 0,0025 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,01 | 0,0024 | 0,0024 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,01 | 0,0024 | 0,0024 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0,01 | 0,0019 | 0,0019 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,00 | 0,0012 | 0,0012 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,00 | 0,0011 | 0,0011 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,00 | 0,0007 | 0,0007 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,00 | 0,0005 | 0,0005 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,00 | 0,0002 | 0,0002 | ||||||

| US26826YAB83 / E2open (10/20) T/L | 0,00 | 0,0000 | 0,0000 | ||||||

| Finco Utilitas BV EUR Term Loan B / LON (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| Medline Borrower LP 2024 USD Add-on Term Loan B / LON (US58503UAF03) | 0,00 | 0,0000 | 0,0000 | ||||||

| KINBN 2025-1XZ2 0% 06-24-2078 / ABS-MBS (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,00 | 0,0000 | 0,0000 | ||||||

| Inspired FinCo Holdings Limited 2023 EUR Term Loan B / LON (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,00 | 0,0000 | 0,0000 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,00 | 0,0000 | 0,0000 | ||||||

| KINBN 2025-RPL1XZ1 0% 06-24-2078 / ABS-MBS (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,00 | 0,0000 | 0,0000 | ||||||

| Bellsola SAU 2024 EUR Term Loan / LON (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| Medline Borrower LP 2024 USD Term Loan B / LON (US58503UAE38) | 0,00 | 0,0000 | 0,0000 | ||||||

| Mill City Mortgage Loan Trust 2019-1 / ABS-MBS (US59981AAR77) | 0,00 | 0,0000 | −0,0000 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,00 | 0,0000 | 0,0000 | ||||||

| Ensemble RCM LLC 2024 Term Loan B / LON (US29359BAE11) | 0,00 | 0,0000 | 0,0000 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,00 | 0,0000 | 0,0000 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,00 | 0,0000 | 0,0000 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,00 | 0,0000 | 0,0000 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,00 | 0,0000 | 0,0000 | ||||||

| Mill City Mortgage Loan Trust 2018-4 / ABS-MBS (US59980YAS46) | 0,00 | 0,0000 | −0,0000 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,00 | 0,0000 | 0,0000 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | −0,00 | −0,0003 | −0,0003 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | −0,00 | −0,0003 | −0,0003 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | −0,00 | −0,0005 | −0,0005 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | −0,00 | −0,0007 | −0,0007 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | −0,00 | −0,0008 | −0,0008 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | −0,00 | −0,0009 | −0,0009 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | −0,00 | −0,0010 | −0,0010 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | −0,00 | −0,0010 | −0,0010 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | −0,00 | −0,0011 | −0,0011 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | −0,00 | −0,0012 | −0,0012 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | −0,00 | −0,0013 | −0,0013 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | −0,00 | −0,0017 | −0,0017 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | −0,01 | −0,0018 | −0,0018 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | −0,01 | −0,0019 | −0,0019 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | −0,01 | −0,0019 | −0,0019 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | −0,01 | −0,0020 | −0,0020 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | −0,01 | −0,0021 | −0,0021 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | −0,01 | −0,0022 | −0,0022 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | −0,01 | −0,0026 | −0,0026 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | −0,01 | −0,0028 | −0,0028 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | −0,01 | −0,0032 | −0,0032 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | −0,01 | −0,0032 | −0,0032 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | −0,01 | −0,0044 | −0,0044 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | −0,02 | −0,0064 | −0,0064 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | −0,02 | −0,0072 | −0,0072 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | −0,02 | −0,0074 | −0,0074 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | −0,03 | −0,0102 | −0,0102 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | −0,04 | −0,0121 | −0,0121 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | −0,04 | −0,0123 | −0,0123 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | −0,04 | −0,0128 | −0,0128 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | −0,04 | −0,0130 | −0,0130 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | −0,04 | −0,0137 | −0,0137 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | −0,05 | −0,0153 | −0,0153 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | −0,05 | −0,0174 | −0,0174 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | −0,06 | −0,0188 | −0,0188 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | −0,06 | −0,0217 | −0,0217 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | −0,07 | −0,0225 | −0,0225 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | −0,08 | −0,0260 | −0,0260 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | −0,09 | −0,0308 | −0,0308 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | −0,10 | −0,0321 | −0,0321 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | −0,11 | −0,0361 | −0,0361 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | −0,28 | −0,0941 | −0,0941 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | −0,40 | −0,1357 | −0,1357 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | −0,43 | −0,1443 | −0,1443 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | −0,48 | −0,1633 | −0,1633 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | −0,54 | −0,1809 | −0,1809 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | −0,59 | −0,1993 | −0,1993 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | −0,67 | −0,2265 | −0,2265 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | −1,34 | −0,4518 | −0,4518 |