Grundläggande statistik

| Portföljvärde | $ 1 150 016 086 |

| Aktuella positioner | 182 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

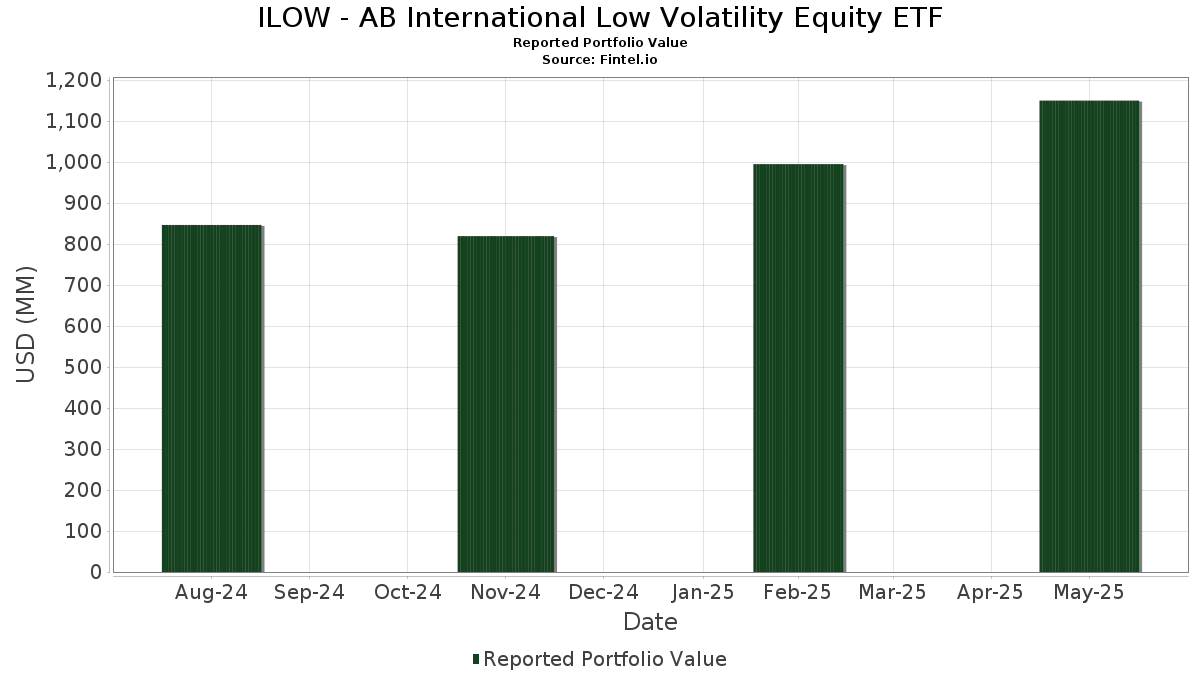

ILOW - AB International Low Volatility Equity ETF har redovisat 182 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 1 150 016 086 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). ILOW - AB International Low Volatility Equity ETFs största innehav är BAE Systems plc (GB:BA.) , SAP SE - Depositary Receipt (Common Stock) (US:SAP) , RELX PLC (DE:RDEB) , Shell plc (NL:SHELL) , and Tesco PLC (US:TSCDF) . ILOW - AB International Low Volatility Equity ETFs nya positioner inkluderar Canadian Tire Corporation, Limited (US:CDNAF) , Persol Holdings Co.,Ltd. (JP:2181) , Aristocrat Leisure Limited (US:ARLUF) , Toyo Suisan Kaisha, Ltd. (US:TSUKF) , and Bunzl plc (MX:BNZL N) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 0,07 | 9,35 | 0,8010 | 0,8010 | |

| 1,22 | 31,38 | 2,6888 | 0,7432 | |

| 4,61 | 8,63 | 0,7391 | 0,7391 | |

| 0,18 | 7,25 | 0,6207 | 0,6207 | |

| 0,10 | 6,82 | 0,5842 | 0,5842 | |

| 1,15 | 17,36 | 1,4877 | 0,5664 | |

| 0,07 | 19,75 | 1,6918 | 0,5208 | |

| 0,05 | 8,98 | 0,7694 | 0,4842 | |

| 0,96 | 13,88 | 1,1895 | 0,4492 | |

| 0,13 | 4,18 | 0,3583 | 0,3583 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 0,28 | 19,21 | 1,6458 | −0,7404 | |

| 0,01 | 8,68 | 0,7438 | −0,6395 | |

| 0,10 | 16,20 | 1,3877 | −0,5150 | |

| 0,34 | 9,48 | 0,8122 | −0,4322 | |

| 1,49 | 18,77 | 1,6081 | −0,3774 | |

| 0,77 | 25,43 | 2,1790 | −0,3763 | |

| 0,01 | 9,67 | 0,8284 | −0,3323 | |

| 0,13 | 19,23 | 1,6474 | −0,3262 | |

| 2,84 | 20,12 | 1,7236 | −0,2777 | |

| 0,10 | 30,99 | 2,6552 | −0,2707 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-07-25 för rapporteringsperioden 2025-05-31. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | Genomsnittligt aktiepris | Aktier (MM) |

ΔAktier (%) |

ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| BA. / BAE Systems plc | 1,22 | 11,34 | 31,38 | 61,21 | 2,6888 | 0,7432 | |||

| SAP / SAP SE - Depositary Receipt (Common Stock) | 0,10 | −3,25 | 30,99 | 5,85 | 2,6552 | −0,2707 | |||

| RDEB / RELX PLC | 0,52 | 19,78 | 27,89 | 34,20 | 2,3896 | 0,3126 | |||

| SHELL / Shell plc | 0,77 | −0,05 | 25,43 | −0,53 | 2,1790 | −0,3763 | |||

| TSCDF / Tesco PLC | 4,43 | 12,03 | 23,17 | 22,44 | 1,9855 | 0,0940 | |||

| RYSD / NatWest Group plc | 2,84 | −14,39 | 20,12 | 0,46 | 1,7236 | −0,2777 | |||

| PM / Philip Morris International Inc. | 0,11 | −3,18 | 19,93 | 12,60 | 1,7076 | −0,0613 | |||

| SAFRY / Safran SA - Depositary Receipt (Common Stock) | 0,07 | 47,71 | 19,75 | 68,54 | 1,6918 | 0,5208 | |||

| CS / AXA SA | 0,42 | 11,87 | 19,72 | 35,39 | 1,6898 | 0,2339 | |||

| LDNXF / London Stock Exchange Group plc | 0,13 | −4,49 | 19,23 | −2,63 | 1,6474 | −0,3262 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0,28 | 4,73 | 19,21 | −19,55 | 1,6458 | −0,7404 | |||

| CMPGF / Compass Group PLC | 0,53 | 12,44 | 18,79 | 13,13 | 1,6095 | −0,0500 | |||

| OCBA / Oversea-Chinese Banking Corporation Limited | 1,49 | −4,22 | 18,77 | −5,53 | 1,6081 | −0,3774 | |||

| CNSWF / Constellation Software Inc. | 0,01 | 1,46 | 18,67 | 6,06 | 1,5996 | −0,1597 | |||

| MFZ / Mitsubishi UFJ Financial Group, Inc. | 1,33 | 4,72 | 18,63 | 16,40 | 1,5963 | −0,0033 | |||

| UNCRY / UniCredit S.p.A. - Depositary Receipt (Common Stock) | 0,29 | −2,09 | 18,59 | 19,44 | 1,5927 | 0,0373 | |||

| PRY / Tion Renewables AG | 0,29 | 4,73 | 18,52 | 13,44 | 1,5871 | −0,0449 | |||

| NN / NN Group N.V. | 0,29 | 13,14 | 18,24 | 40,31 | 1,5626 | 0,2636 | |||

| SNEJF / Sony Group Corporation | 0,68 | 28,21 | 17,85 | 36,45 | 1,5297 | 0,2220 | |||

| KBC / KBC Group NV | 0,18 | 12,43 | 17,75 | 27,69 | 1,5208 | 0,1315 | |||

| NG. / National Grid plc | 1,24 | −5,35 | 17,50 | 8,81 | 1,4997 | −0,1080 | |||

| IGGRF / IG Group Holdings plc | 1,15 | 49,21 | 17,36 | 88,35 | 1,4877 | 0,5664 | |||

| STN / Stantec Inc. | 0,17 | 4,73 | 17,29 | 25,67 | 1,4811 | 0,1064 | |||

| WTKWY / Wolters Kluwer N.V. - Depositary Receipt (Common Stock) | 0,10 | −3,37 | 17,25 | 11,70 | 1,4783 | −0,0655 | |||

| AZN / Astrazeneca plc | 0,12 | 12,22 | 17,00 | 7,65 | 1,4566 | −0,1217 | |||

| PSORF / Pearson plc | 1,07 | 20,20 | 16,83 | 10,15 | 1,4422 | −0,0850 | |||

| TSMWF / Taiwan Semiconductor Manufacturing Company Limited | 0,51 | 17,62 | 16,59 | 19,75 | 1,4210 | 0,0367 | |||

| SMFNF / Sumitomo Mitsui Financial Group, Inc. | 0,64 | 4,64 | 16,54 | 6,63 | 1,4168 | −0,1331 | |||

| ENX / Euronext N.V. | 0,10 | −34,13 | 16,20 | −14,93 | 1,3877 | −0,5150 | |||

| IDEXY / Industria de Diseño Textil, S.A. - Depositary Receipt (Common Stock) | 0,30 | 4,73 | 16,18 | 4,91 | 1,3860 | −0,1551 | |||

| NDB / Nordea Bank Abp | 1,12 | 4,73 | 16,16 | 15,11 | 1,3847 | −0,0186 | |||

| T2V1 / Tryg A/S | 0,62 | 27,73 | 16,04 | 49,88 | 1,3740 | 0,3046 | |||

| NTULF / BIPROGY Inc. | 0,40 | 0,30 | 16,02 | 42,54 | 1,3722 | 0,2492 | |||

| SBGSY / Schneider Electric S.E. - Depositary Receipt (Common Stock) | 0,06 | 16,66 | 15,56 | 20,48 | 1,3331 | 0,0425 | |||

| 8801 / Mitsui Fudosan Co., Ltd. | 1,56 | 34,45 | 15,02 | 50,13 | 1,2873 | 0,2871 | |||

| ENLAY / Enel SpA - Depositary Receipt (Common Stock) | 1,61 | −4,10 | 14,82 | 19,90 | 1,2698 | 0,0344 | |||

| HNDAF / Honda Motor Co., Ltd. | 1,41 | 4,80 | 14,37 | 15,35 | 1,2310 | −0,0139 | |||

| GL9 / Glanbia plc | 0,96 | 48,62 | 13,88 | 87,43 | 1,1895 | 0,4492 | |||

| AMADY / Amadeus IT Group, S.A. - Depositary Receipt (Common Stock) | 0,17 | 4,74 | 13,87 | 15,37 | 1,1888 | −0,0132 | |||

| US0186167484 / AB Fixed Income Shares, Inc. - Government Money Market Portfolio | 13,73 | 9,23 | 13,73 | 9,23 | 1,1759 | −0,0798 | |||

| CHGCF / Chugai Pharmaceutical Co., Ltd. | 0,26 | 5,11 | 13,72 | 11,18 | 1,1756 | −0,0578 | |||

| ASBRF / Asahi Group Holdings, Ltd. | 1,03 | 22,52 | 13,56 | 30,90 | 1,1614 | 0,1265 | |||

| IEA / Informa plc | 1,24 | 4,73 | 13,11 | 2,55 | 1,1233 | −0,1543 | |||

| ABBNY / ABB Ltd - Depositary Receipt (Common Stock) | 0,23 | 4,73 | 12,80 | 10,80 | 1,0970 | −0,0579 | |||

| ADRNY / Koninklijke Ahold Delhaize N.V. - Depositary Receipt (Common Stock) | 0,29 | −8,73 | 12,17 | 9,04 | 1,0424 | −0,0727 | |||

| ALV / Allianz SE | 0,03 | −15,37 | 11,57 | −2,48 | 0,9912 | −0,1944 | |||

| KPN / Koninklijke KPN N.V. | 2,46 | 4,73 | 11,54 | 28,56 | 0,9890 | 0,0916 | |||

| FRE / Frendy Energy S.p.A. | 0,23 | −13,48 | 11,50 | 6,04 | 0,9857 | −0,0986 | |||

| VCISY / Vinci SA - Depositary Receipt (Common Stock) | 0,08 | −9,08 | 11,40 | 12,43 | 0,9766 | −0,0367 | |||

| REC / Recordati Industria Chimica e Farmaceutica S.p.A. | 0,18 | 38,19 | 11,04 | 46,68 | 0,9455 | 0,1936 | |||

| LUMI / Bank Leumi le-Israel B.M. | 0,67 | 17,42 | 10,85 | 42,27 | 0,9294 | 0,1674 | |||

| RHHBY / Roche Holding AG - Depositary Receipt (Common Stock) | 0,03 | 4,75 | 10,72 | 2,09 | 0,9186 | −0,1310 | |||

| H6D0 / Haleon plc | 1,92 | −0,73 | 10,72 | 10,46 | 0,9184 | −0,0515 | |||

| NURAF / Nomura Research Institute, Ltd. | 0,27 | 5,03 | 10,50 | 22,94 | 0,8992 | 0,0460 | |||

| 6823 / HKT Trust and HKT Limited - Debt/Equity Composite Units | 6,96 | 26,68 | 10,02 | 42,39 | 0,8588 | 0,1553 | |||

| O4H / Open House Group Co., Ltd. | 0,23 | 15,43 | 9,91 | 37,13 | 0,8488 | 0,1268 | |||

| ASML / ASML Holding N.V. | 0,01 | −20,85 | 9,67 | −16,75 | 0,8284 | −0,3323 | |||

| MPL / Medibank Private Limited | 3,09 | 4,73 | 9,49 | 18,84 | 0,8127 | 0,0151 | |||

| HIA1 / Hitachi, Ltd. | 0,34 | −32,43 | 9,48 | −23,87 | 0,8122 | −0,4322 | |||

| SAN / Santander UK plc - Preferred Stock | 0,09 | 4,73 | 9,43 | −4,13 | 0,8079 | −0,1751 | |||

| 2588 / BOC Aviation Limited | 1,16 | 0,00 | 9,41 | 4,96 | 0,8063 | −0,0898 | |||

| CDNAF / Canadian Tire Corporation, Limited | 0,07 | 9,35 | 0,8010 | 0,8010 | |||||

| NICE / NICE Ltd. - Depositary Receipt (Common Stock) | 0,05 | 171,80 | 8,98 | 214,83 | 0,7694 | 0,4842 | |||

| SOU / Singapore Exchange Limited | 0,83 | −13,65 | 8,97 | −5,87 | 0,7686 | −0,1838 | |||

| DTEGY / Deutsche Telekom AG - Depositary Receipt (Common Stock) | 0,23 | 4,73 | 8,86 | 9,48 | 0,7589 | −0,0496 | |||

| MUV2 / Münchener Rückversicherungs-Gesellschaft Aktiengesellschaft in München | 0,01 | −45,04 | 8,68 | −37,28 | 0,7438 | −0,6395 | |||

| 2181 / Persol Holdings Co.,Ltd. | 4,61 | 8,63 | 0,7391 | 0,7391 | |||||

| GALE / Galenica AG | 0,08 | 4,74 | 8,45 | 21,44 | 0,7236 | 0,0286 | |||

| DEVL / DBS Group Holdings Ltd | 0,24 | −12,67 | 8,27 | −11,01 | 0,7085 | −0,2202 | |||

| 2UA / Auto Trader Group plc | 0,73 | −2,59 | 7,81 | 6,80 | 0,6690 | −0,0617 | |||

| BNR / Burning Rock Biotech Limited - Depositary Receipt (Common Stock) | 0,11 | 4,73 | 7,59 | 6,84 | 0,6503 | −0,0597 | |||

| ARLUF / Aristocrat Leisure Limited | 0,18 | 7,25 | 0,6207 | 0,6207 | |||||

| JXHGF / ENEOS Holdings, Inc. | 1,52 | −5,37 | 7,23 | −15,21 | 0,6193 | −0,2327 | |||

| AAGIY / AIA Group Limited - Depositary Receipt (Common Stock) | 0,82 | 0,00 | 6,85 | 9,61 | 0,5865 | −0,0377 | |||

| TSUKF / Toyo Suisan Kaisha, Ltd. | 0,10 | 6,82 | 0,5842 | 0,5842 | |||||

| HIK / Hikari Tsushin, Inc. | 0,22 | −3,85 | 6,49 | 2,03 | 0,5557 | −0,0796 | |||

| LBLCF / Loblaw Companies Limited | 0,03 | −17,37 | 5,51 | 5,82 | 0,4720 | −0,0483 | |||

| DOX / Amdocs Limited | 0,06 | −17,70 | 5,51 | −13,44 | 0,4717 | −0,1640 | |||

| SOMLF / SECOM CO., LTD. | 0,15 | 5,53 | 5,44 | 12,80 | 0,4658 | −0,0159 | |||

| RIO / Rio Tinto Group | 0,07 | −4,89 | 5,06 | −2,18 | 0,4339 | −0,0835 | |||

| RY / Royal Bank of Canada | 0,04 | −6,66 | 4,95 | −0,50 | 0,4237 | −0,0731 | |||

| NSRGY / Nestlé S.A. - Depositary Receipt (Common Stock) | 0,04 | 4,74 | 4,53 | 15,79 | 0,3882 | −0,0029 | |||

| BKNG / Booking Holdings Inc. | 0,00 | −28,35 | 4,49 | −21,17 | 0,3849 | −0,1846 | |||

| BNZL N / Bunzl plc | 0,13 | 4,18 | 0,3583 | 0,3583 | |||||

| JEP / SalMar ASA | 0,09 | 4,72 | 4,15 | −5,85 | 0,3557 | −0,0850 | |||

| FP / TotalEnergies SE | 0,07 | −23,07 | 4,07 | −24,91 | 0,3487 | −0,1930 | |||

| EXPGF / Experian plc | 0,08 | −23,03 | 4,03 | −19,13 | 0,3456 | −0,1528 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0,03 | −29,79 | 3,83 | −25,76 | 0,3277 | −0,1872 | |||

| PURCHASED AUD / SOLD USD / DFE (000000000) | 3,56 | 0,3047 | 0,3047 | ||||||

| JRONY / Jerónimo Martins, SGPS, S.A. - Depositary Receipt (Common Stock) | 0,13 | 4,73 | 3,28 | 22,04 | 0,2813 | 0,0124 | |||

| CNI / Canadian National Railway Company | 0,03 | −40,05 | 2,84 | −38,24 | 0,2436 | −0,2164 | |||

| LOGN / Logitech International S.A. | 0,02 | −41,53 | 1,83 | −50,28 | 0,1570 | −0,2113 | |||

| US63906EB929 / NatWest Markets PLC | 0,32 | 0,0272 | 0,0272 | ||||||

| US63906EB929 / NatWest Markets PLC | 0,32 | 0,0272 | 0,0272 | ||||||

| US63906EB929 / NatWest Markets PLC | 0,32 | 0,0272 | 0,0272 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0,05 | 0,0046 | 0,0046 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0,05 | 0,0046 | 0,0046 | ||||||

| DGZ / DB Gold Short ETN | 0,05 | 0,0040 | 0,0040 | ||||||

| DGZ / DB Gold Short ETN | 0,05 | 0,0040 | 0,0040 | ||||||

| PURCHASED USD / SOLD ILS / DFE (000000000) | 0,04 | 0,0033 | 0,0033 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,03 | 0,0028 | 0,0028 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,03 | 0,0028 | 0,0028 | ||||||

| PURCHASED CHF / SOLD USD / DFE (000000000) | 0,03 | 0,0023 | 0,0023 | ||||||

| PURCHASED CHF / SOLD USD / DFE (000000000) | 0,03 | 0,0023 | 0,0023 | ||||||

| PURCHASED CHF / SOLD USD / DFE (000000000) | 0,03 | 0,0023 | 0,0023 | ||||||

| PURCHASED JPY / SOLD USD / DFE (000000000) | 0,03 | 0,0022 | 0,0022 | ||||||

| PURCHASED JPY / SOLD USD / DFE (000000000) | 0,03 | 0,0022 | 0,0022 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,02 | 0,0019 | 0,0019 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,02 | 0,0019 | 0,0019 | ||||||

| PURCHASED AUD / SOLD USD / DFE (000000000) | 0,02 | 0,0017 | 0,0017 | ||||||

| PURCHASED AUD / SOLD USD / DFE (000000000) | 0,02 | 0,0017 | 0,0017 | ||||||

| PURCHASED AUD / SOLD USD / DFE (000000000) | 0,02 | 0,0017 | 0,0017 | ||||||

| PURCHASED USD / SOLD AUD / DFE (000000000) | 0,01 | 0,0009 | 0,0009 | ||||||

| PURCHASED USD / SOLD AUD / DFE (000000000) | 0,01 | 0,0009 | 0,0009 | ||||||

| PURCHASED USD / SOLD AUD / DFE (000000000) | 0,01 | 0,0009 | 0,0009 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,01 | 0,0005 | 0,0005 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,01 | 0,0005 | 0,0005 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,01 | 0,0005 | 0,0005 | ||||||

| US63906EB929 / NatWest Markets PLC | 0,00 | 0,0003 | 0,0003 | ||||||

| US63906EB929 / NatWest Markets PLC | 0,00 | 0,0003 | 0,0003 | ||||||

| US63906EB929 / NatWest Markets PLC | 0,00 | 0,0003 | 0,0003 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | ||||||

| PURCHASED USD / SOLD SGD / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | ||||||

| PURCHASED USD / SOLD SGD / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | ||||||

| CA21037X1345 / CONSTELLATION SOFTWARE INC | 0,01 | 0,00 | 0,00 | 0,0000 | 0,0000 | ||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | −0,00 | −0,0002 | −0,0002 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | −0,00 | −0,0002 | −0,0002 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | −0,00 | −0,0004 | −0,0004 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | −0,00 | −0,0004 | −0,0004 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | −0,00 | −0,0004 | −0,0004 | ||||||

| DGZ / DB Gold Short ETN | −0,00 | −0,0004 | −0,0004 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | −0,01 | −0,0004 | −0,0004 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | −0,01 | −0,0004 | −0,0004 | ||||||

| PURCHASED USD / SOLD CAD / DFE (000000000) | −0,01 | −0,0005 | −0,0005 | ||||||

| PURCHASED USD / SOLD CAD / DFE (000000000) | −0,01 | −0,0005 | −0,0005 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | −0,01 | −0,0005 | −0,0005 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | −0,01 | −0,0005 | −0,0005 | ||||||

| PURCHASED USD / SOLD TWD / DFE (000000000) | −0,01 | −0,0005 | −0,0005 | ||||||

| PURCHASED USD / SOLD TWD / DFE (000000000) | −0,01 | −0,0005 | −0,0005 | ||||||

| PURCHASED NOK / SOLD USD / DFE (000000000) | −0,01 | −0,0008 | −0,0008 | ||||||

| PURCHASED NOK / SOLD USD / DFE (000000000) | −0,01 | −0,0008 | −0,0008 | ||||||

| US63906EB929 / NatWest Markets PLC | −0,02 | −0,0013 | −0,0013 | ||||||

| US63906EB929 / NatWest Markets PLC | −0,02 | −0,0013 | −0,0013 | ||||||

| US63906EB929 / NatWest Markets PLC | −0,02 | −0,0018 | −0,0018 | ||||||

| US63906EB929 / NatWest Markets PLC | −0,02 | −0,0018 | −0,0018 | ||||||

| US63906EB929 / NatWest Markets PLC | −0,02 | −0,0018 | −0,0018 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | −0,02 | −0,0020 | −0,0020 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | −0,02 | −0,0020 | −0,0020 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | −0,02 | −0,0020 | −0,0020 | ||||||

| DGZ / DB Gold Short ETN | −0,03 | −0,0024 | −0,0024 | ||||||

| DGZ / DB Gold Short ETN | −0,03 | −0,0024 | −0,0024 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | −0,03 | −0,0026 | −0,0026 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | −0,05 | −0,0041 | −0,0041 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | −0,05 | −0,0041 | −0,0041 | ||||||

| PURCHASED JPY / SOLD USD / DFE (000000000) | −0,05 | −0,0045 | −0,0045 | ||||||

| PURCHASED JPY / SOLD USD / DFE (000000000) | −0,05 | −0,0045 | −0,0045 | ||||||

| PURCHASED JPY / SOLD USD / DFE (000000000) | −0,06 | −0,0049 | −0,0049 | ||||||

| DGZ / DB Gold Short ETN | −0,06 | −0,0053 | −0,0053 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | −0,08 | −0,0072 | −0,0072 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | −0,08 | −0,0072 | −0,0072 | ||||||

| PURCHASED USD / SOLD CAD / DFE (000000000) | −0,12 | −0,0101 | −0,0101 | ||||||

| PURCHASED USD / SOLD CAD / DFE (000000000) | −0,12 | −0,0101 | −0,0101 | ||||||

| PURCHASED USD / SOLD CAD / DFE (000000000) | −0,12 | −0,0101 | −0,0101 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | −0,15 | −0,0128 | −0,0128 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | −0,15 | −0,0128 | −0,0128 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | −0,15 | −0,0128 | −0,0128 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | −0,15 | −0,0128 | −0,0128 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | −0,17 | −0,0142 | −0,0142 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | −0,17 | −0,0142 | −0,0142 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | −0,17 | −0,0142 | −0,0142 | ||||||

| PURCHASED USD / SOLD ILS / DFE (000000000) | −0,23 | −0,0197 | −0,0197 | ||||||

| PURCHASED USD / SOLD ILS / DFE (000000000) | −0,23 | −0,0197 | −0,0197 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | −0,24 | −0,0208 | −0,0208 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | −0,24 | −0,0208 | −0,0208 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | −0,24 | −0,0208 | −0,0208 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | −0,99 | −0,0852 | −0,0852 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | −0,99 | −0,0852 | −0,0852 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | −1,41 | −0,1205 | −0,1205 | ||||||

| DGZ / DB Gold Short ETN | −1,87 | −0,1599 | −0,1599 | ||||||

| DGZ / DB Gold Short ETN | −1,87 | −0,1599 | −0,1599 | ||||||

| DGZ / DB Gold Short ETN | −1,87 | −0,1599 | −0,1599 |